The evolution of GenAI

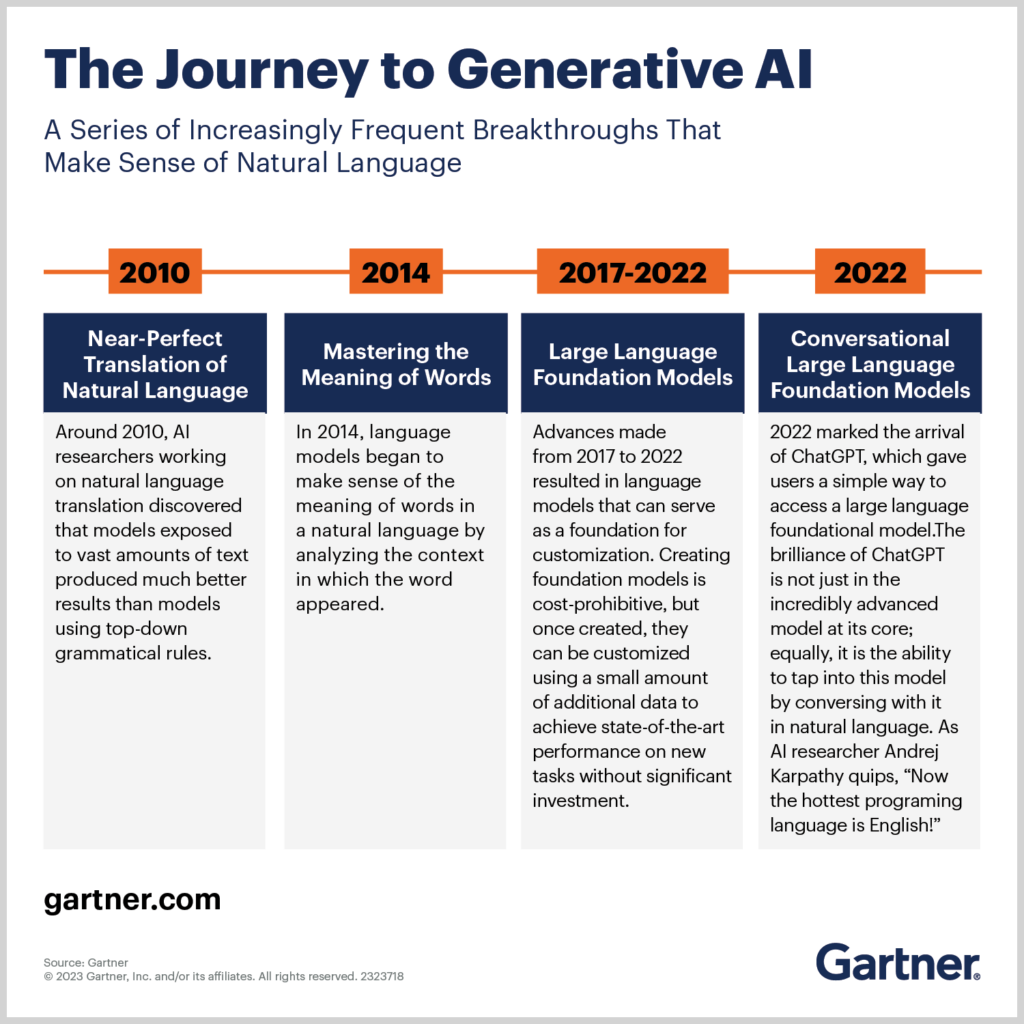

Within the last 15 years, Generative AI has made remarkable strides. In 2010, breakthroughs in natural language translation emerged, leveraging vast datasets to achieve significant improvements in accuracy. By 2014, models advanced further by understanding the meanings of words through contextual analysis, enhancing their ability to process and interpret language. Between 2017 and 2022, the development of large foundational language models enabled cost-effective customization for a wide range of tasks, making AI applications more accessible. Finally, in 2022, the debut of ChatGPT marked a milestone by providing intuitive access to advanced language models through natural, conversational interfaces.

In short, Generative AI has revolutionized the way technology interacts with humans, with applications across multiple domains:

- Text Generation: Facilitates content creation, chatbots, and summarization through human-like language production.

- Image Generation: Creates lifelike images, transforming industries such as graphic design and art.

- Code Generation: Speeds up software development by automating code snippets.

- Natural Language Understanding: Enhances context comprehension, enabling meaningful interactions.

A focus in insurance industry

Generative AI is rapidly gaining traction in the insurance industry, with three key categories of use cases emerging as the most promising.

The first and most prevalent application is leveraging GenAI models to extract valuable insights from unstructured data. In claims processing, this could involve synthesizing information from medical records or extracting details from demand packages. For commercial property and casualty (P&C) underwriting, GenAI enables the seamless analysis of broker submissions, helping underwriters efficiently search and query risk appetite and underwriting guidelines. Beyond underwriting and claims, data-driven AI assets have the potential to revolutionize claims management by improving prevention measures, accelerating notifications and settlements, and strengthening fraud detection systems.

The second category centers on content generation, particularly for creative and personalized communication. In marketing, GenAI helps insurers create targeted messaging that resonates with specific customer segments. In claims processing, it facilitates detailed updates to claimants, capturing the nuances of individual cases. Similarly, GenAI supports underwriters by simplifying communication and negotiation with brokers.

The third and final category involves coding and software development. This is particularly critical as many insurance companies continue to modernize legacy systems. GenAI can automate aspects of software development, addressing the industry’s need for enhanced digital tools to improve efficiency and scalability.

Generative AI offers transformative potential in insurance claims management, combining automation and personalization to address challenges such as data scarcity. It enhances fraud detection by integrating and analyzing diverse data sources, broadening the landscape for more accurate insights. Looking ahead, GenAI promises to empower organizations to prevent claims proactively, emphasizing privacy, data diversity, and user-friendly solutions to create a more resilient and efficient insurance ecosystem.

Property & Casualty (P&C)

Generative AI is transforming P&C insurance by improving risk assessment, claim processing, and fraud detection while empowering underwriters with data insights:

- Claim Processing: Automating analysis of documents like accident reports and damage assessments speeds up resolution times.

- Fraud Mitigation: AI identifies inconsistencies in claims, such as fabricated damages or staged accidents.

- Risk Analysis: AI models assess potential hazards, enabling more accurate pricing and better resource allocation.

Life & Annuity (L&A)

In life and annuity insurance, GenAI drives personalization and efficiency, by analyzing customer profiles , ensuring faster and more precise policy recommendations.

- Tailored Policies: AI evaluates individual health history, financial status, and lifestyle to design optimal coverage plans.

- Retirement Planning: Robo-advisors provide personalized investment and retirement strategies based on user goals and risk tolerance.

- Efficient Onboarding: Automating customer data analysis shortens onboarding timelines while maintaining precision.

Challenges and Risk Mitigation

Despite its promise, the adoption of GenAI in insurance comes with challenges. Human capital issues, including skill gaps and resistance to change, can slow its integration. Additionally, insurers face risks such as:

- Data Privacy and Security: Ensuring the safety of sensitive information and compliance with regulations is paramount.

- Accuracy and Hallucinations: GenAI’s tendency to produce errors or fabricate outputs necessitates robust validation systems.

- Fraudulent Use Cases: Technologies like image generation can be exploited to create fraudulent claims, presenting a new layer of risk for insurers.

To address these challenges, a robust AI governance framework should encompass:

- continuous monitoring of AI model outputs;

- regular audits to ensure compliance with ethical guidelines;

- risk assessment protocols for AI-generated insights.

Future Outlook

Generative AI is more than just a technological innovation; it represents a paradigm shift in how insurers approach business operations and customer interactions. Insurers who invest strategically in GenAI stand to gain competitive advantages, unlocking new avenues for growth and efficiency.

Total Value Chain Transformation

Investments are expected to expand from enabling existing processes to reimagining them entirely. For instance:

- Claims Prevention: AI empowers insurers to predict and mitigate risks before claims occur, leading to significant cost savings.

- Smart Underwriting: Risk assessments based on real-time and historical data create highly personalized, fair pricing models.

Enhanced Customer Engagement

Future advancements in AI will allow insurers to provide deeply personalized experiences, from tailored policy recommendations to predictive retention strategies.

Competitive Edge Through Innovation

Early adopters of Generative AI will establish themselves as industry leaders, capturing market share and driving customer loyalty.

Note: The header image of this blog post was created by Gen AI tools